The global specialty chemical industry, valued at over USD 900 billion, is projected to grow at around 5–6% CAGR through

2030. While Europe and the US remain major consumption centers, sourcing patterns are shifting rapidly. Increasingly,

multinational companies are turning to India for their specialty chemical needs — and the reasons go far beyond cost.

1. Competitive Advantage Through Cost and Scale

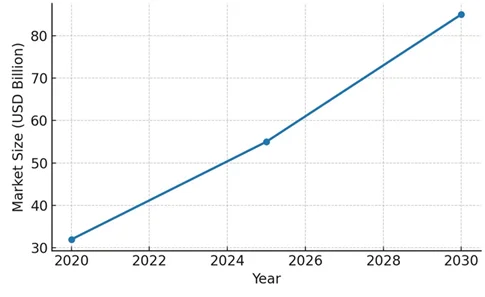

India’s Specialty Chemical Market Projections.

India has become one of the world’s fastest-growing specialty chemical hubs. According to industry estimates, the

country’s specialty chemical market is expected to reach USD 80–85 billion by 2030, driven by both domestic consumption

and exports.

- Lower production costs (30–40% compared to Western suppliers)

- Strong availability of skilled chemists and engineers

- Expanding manufacturing infrastructure in chemical clusters like Gujarat and Maharashtra

This combination makes India an ideal partner for global companies seeking to optimize costs without compromising

quality.

2. R&D-Driven Customization

Unlike large commodity suppliers, Indian specialty chemical companies are investing heavily in application-oriented R&D.

- India spends ~8–10% of revenues on product development in niche segments such as electronic chemicals, advanced intermediates, and performance additives.

- Global companies value the ability to source low-volume, high-value intermediates with tailor-made specifications.

This shift from being just suppliers to co-innovation partners is a key driver behind global trust in Indian firms.

3. Compliance and Sustainability as a Differentiator

With the EU’s Green Deal, Japan’s stricter import norms, and the US’s rising compliance requirements, sustainability has become a commercial necessity. Leading Indian manufacturers are adopting:

- Zero liquid discharge (ZLD) and zero-effluent systems

- Cleaner reaction pathways to minimize waste

- Documentation aligned with REACH and global standards

This positions India as not just a low-cost option, but a compliant, reliable, and future-ready sourcing base.

4. Supply Chain Resilience and Diversification

Recent global disruptions (China+1 strategy, COVID-era logistics crises) have pushed buyers to diversify supply chains.

- India’s strategic location between East and West enables efficient exports.

- Multinationals are actively moving part of their sourcing away from China, with India emerging as the natural alternative.

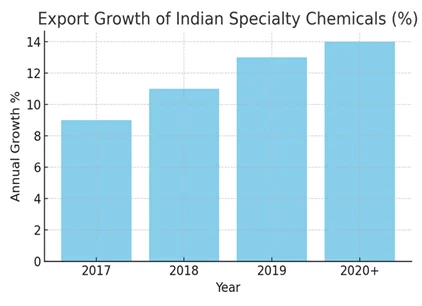

According to FICCI, India’s specialty chemical exports have grown 13–14% annually in the past five years, despite global slowdowns

5. Trust and Partnership Ethos

Global buyers are no longer seeking transactional suppliers — they want long-term, trustworthy partners. Indian companies have gained a reputation for:

- Flexibility in scale (from lab grams to multi-kilo lots)

- Transparent collaboration models

- Strong customer service mindset

This trust factor is what converts buyers into repeat clients.

What This Means for Global Companies

The decision to move sourcing to India is strategic, not tactical. It’s about securing:

- High-purity specialty chemicals at globally competitive costs

- Sustainable, compliant processes that align with future regulations

- A partnership approach that supports innovation pipelines

India is not just supplying specialty chemicals — it is enabling global innovation.

To Conclude

The specialty chemical industry is at a crossroads: performance alone is no longer enough. Global companies are choosing India because it offers a blend of cost, compliance, customization, and trust.

Trusted partners in India are proving that sustainability and reliability can go hand in hand — and that’s why more companies are making the shift.